INTRODUCTION

Hey land enthusiasts!

This week we're unlocking the underutilized treasure maps known as county comprehensive plans - those unassuming government documents that signal where growth is headed years before the market catches on. Our four-part series begins with a deep dive into how investors use these public blueprints to position themselves ahead of inevitable development waves.

Whether you're a seasoned land flipper or just starting out, mastering this overlooked research tool can dramatically change your acquisition strategy. After all, the most profitable investments often come from seeing what others miss in plain sight. Let's pull back the curtain on how forward-thinking investors consistently find tomorrow's hot parcels before anyone else knows to look.

Cheers,

Sean

IDEA

County Comprehensive Plans: The Smart Investor's Secret Weapon

Separate yourself from a vast majority of the competition through what might be real estate's most under appreciated source of valuable market intelligence.

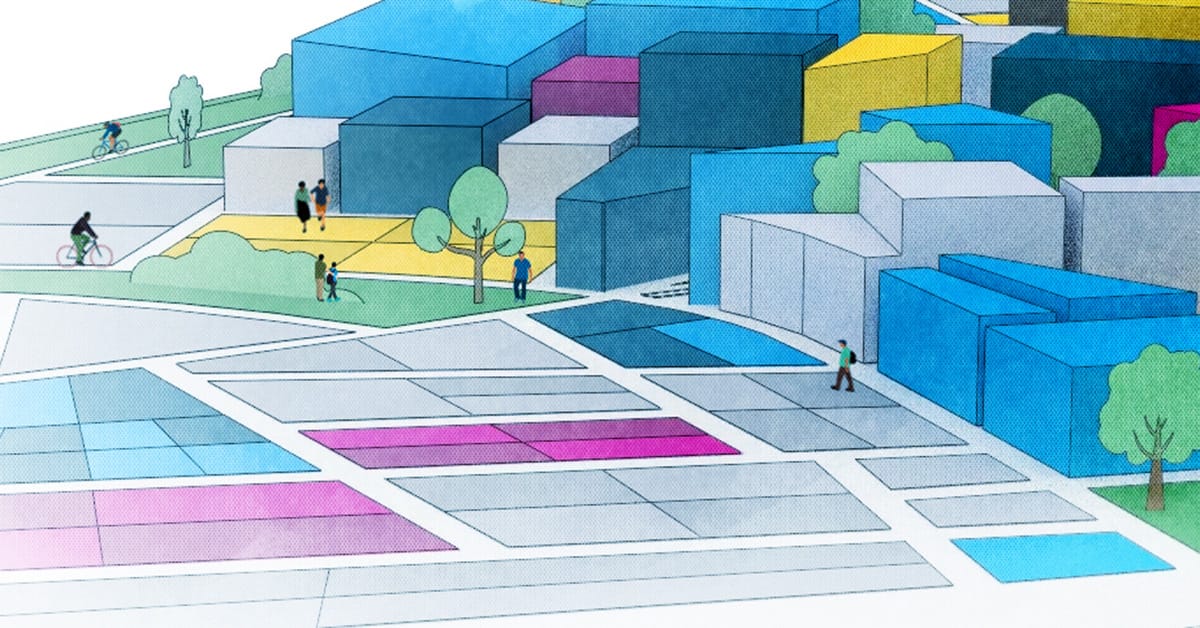

Credit: Urban Institute

First in a four-part series on leveraging county planning documents for profitable land investments

Why Give a Hoot?

Ever wonder how some land investors consistently find opportunities before everyone else? How they manage to buy parcels that suddenly become hot property a few years later? I'll let you in on one of real estate's best-kept secrets: county comprehensive plans.

These publicly available documents are gold mines of information that signal where growth is headed—often years before the market catches on. Yet most small investors never bother to read them.

Let’s look at why that's a massive missed opportunity and how you can gain a serious competitive edge.

What Exactly Is a Comprehensive Plan?

Think of a comprehensive plan as a county's blueprint for the future. It outlines where officials want to see growth, what kind of development they'll encourage, and crucially—where they plan to build or expand infrastructure over the next 10-20 years.

These plans go by different names depending on where you are—master plans, general plans, growth management plans—but they all serve the same purpose: mapping out a community's long-term vision for development.

While not always technically binding, these documents guide zoning decisions, subdivision approvals, and infrastructure investments. In many states, local ordinances must actually align with the comprehensive plan, making them powerful predictors of future development.

Most comprehensive plans get a major update every 10 years, though many counties allow for annual amendments to address changing conditions. This regular refresh cycle creates predictable windows of opportunity for savvy investors.

The Sections You Can't Afford to Miss

These plans are hefty documents—often hundreds of pages—but don't let that intimidate you. Here's where to focus your attention:

Pro Tip: Look for areas where multiple positive factors overlap—like a parcel within a growth boundary that's also near a planned highway expansion and designated for higher-density housing. These "triple threat" locations typically outperform the market by substantial margins.

How to Access These Plans

Getting your hands on comprehensive plans is easier than ever:

Most counties now publish their full plans on official websites, often as downloadable PDFs or interactive web maps

Larger counties frequently offer GIS portals where you can overlay plan designations with property boundaries

For smaller counties, you might need to visit the planning department or request digital copies

Start with the county planning or community development department's website. Search terms like "[County Name] comprehensive plan" or "[County Name] future land use map" usually get you there quickly.

Here's a surprising statistic: Industry surveys suggest only about 30-40% of small-scale land investors actively consult comprehensive plans, while nearly all institutional investors and major developers consider them essential research. That knowledge gap creates opportunity for individual investors willing to do their homework.

The Payoff Can Be Enormous

The potential returns from this approach are substantial. In Central Florida, investors who purchased land in designated growth corridors saw appreciation exceeding 200% within five years after infrastructure was installed according to the comprehensive plan's timeline.

In the Seattle suburbs, parcels incorporated into expanded Urban Growth Areas often doubled in value after being rezoned for residential development following scheduled plan updates.

What's most compelling about this strategy is that it's based on public information—the counties are literally publishing their development intentions for anyone who cares to look. Yet most investors remain fixated on current zoning and present conditions rather than planning for where growth is headed.

The View from Inside: What Planners Say

County planning officials often express appreciation for investors who understand their comprehensive plans. As one Washington State planning official told me:

"We welcome investors who take the time to understand our comprehensive plan. They tend to propose projects that align with our community's vision, making approvals smoother for everyone."

A senior planner in Central Florida shared similar sentiments:

"Engaged investors help us identify market trends and sometimes even bring innovative ideas that fit within our plan's framework."

This insider perspective reveals an important truth: Investors who align their strategies with comprehensive plans not only find better opportunities but often encounter smoother approval processes when development time comes.

Regional Variations to Keep in Mind

Comprehensive plans vary significantly by region:

Understanding these regional differences helps you adapt your investment approach to local conditions.

Reading Plans Efficiently

Don't get overwhelmed by these documents' length. Here's my tried-and-true approach:

Start with the Executive Summary and Future Land Use Map

Use the Table of Contents to jump directly to sections on land use, transportation, and infrastructure

Search for keywords like "growth area," "corridor," "rezoning," and "capital improvements"

Use GIS tools to visualize plan data spatially

Don't hesitate to contact county planners with questions—many welcome inquiries from serious investors

Remember, you don't need to memorize every detail. Focus on identifying growth patterns, infrastructure expansions, and policy shifts that could affect land values.

Essential Terms to Know

As you dive into comprehensive plans, you'll encounter specific terminology:

Understanding these terms helps you extract actionable insights from what might otherwise seem like bureaucratic documents.

Your Unfair Advantage

County comprehensive plans represent one of the most underutilized tools in the land investor's toolkit. By understanding future land use designations, planned infrastructure improvements, and growth boundaries, you can position yourself ahead of market trends rather than chasing them.

The beauty of this approach is its accessibility—this information is public, legally published, and available to anyone willing to invest the time to understand it. Yet most small investors never bother.

That information gap is your opportunity.

In the next article in this series, we'll explore how to analyze comprehensive plan amendments and updates to identify emerging investment opportunities even earlier. Until then, start exploring the comprehensive plans in your target counties—your future self will thank you.

Next in the series: "Plan Amendments and Updates: Catching Investment Opportunities at Their Earliest Stage"

Psst…Want access to action plans, workbooks, sample scripts and more? Our PRO content offers you everything you need to take action on these strategies and make more money in your business. Subscribe using this link and get 25% off for life!

IMPLEMENTATION

AROUND THE HORN

New & Updates

Comprehensive plans often signal upcoming zoning changes and infrastructure investments, potentially easing restrictions on alternative housing and resort developments.

Investors can review and comment on the draft, positioning themselves to benefit from or help shape pro-development policies-especially those favoring innovative housing models or recreational land uses

The proliferation of new RV parks and glamping resorts indicates growing municipal acceptance and streamlined permitting for these non-traditional hospitality developments.

Investors can capitalize on this trend by acquiring land suitable for RV or glamping resorts, leveraging the growing demand and favorable regulatory climate for such projects.

"The land belongs to the future." - Willa Cather