INTRODUCTION

Hey land visionaries!

This week we're venturing further into our exploration of county comprehensive plans, uncovering one of the most overlooked profit centers in today's land market: alternative development opportunities. While traditional developers chase conventional housing plays, savvy investors are quietly capitalizing on the booming demand for tiny homes, container houses, and glamping resorts.

Our second installment reveals exactly how to identify counties where comprehensive plans actively support these non-traditional development types—often years before zoning catches up. It's in this regulatory gap that early movers are consistently generating 50%+ returns while slashing both development timelines and per-unit costs.

Whether you're looking to create unique short-term rental experiences or address the affordable housing crisis, this week's playbook gives you the systematic approach needed to evaluate counties, spot rezoning opportunities, and calculate your ROI potential. After all, the most innovative investors aren't just predicting the future of housing—they're building it while others are still reading conventional zoning maps.

Let's unlock the alternative development goldmine hiding in plain sight!

Cheers, Sean

IDEA

Alternative Development & Zoning: Your Comprehensive Plan Playbook

In our first article, we revealed how county comprehensive plans serve as treasure maps for savvy land investors. Now, let's explore one of the most overlooked and potentially lucrative opportunities these plans can uncover: alternative development opportunities.

Credit: Urban Institute

Second in a four-part series on leveraging county planning documents for profitable land investments

Why Give a Hoot?

While traditional developers focus on conventional single-family homes and apartments, forward-thinking investors are capitalizing on the growing demand for tiny homes, container houses, and glamping resorts. The key? Identifying counties where comprehensive plans actively support these non-traditional development types—often years before zoning catches up.

The Alternative Development Gold Rush

Alternative development isn't just a passing trend. It's a response to fundamental market shifts:

These factors have created substantial profit opportunities for investors who understand how to navigate the regulatory landscape. Let's examine exactly how this works.

COUNTY EVALUATION RUBRIC

EVALUATION FACTORS:

1. LAND USE - Seek: housing diversity, tiny homes, sustainability goals. Avoid: character preservation, high sq ft minimums.

2. INFRASTRUCTURE - Seek: rural water/sewer expansion, improvement budgets, broadband initiatives.

3. TOURISM - For glamping/rentals, seek: rural tourism plans, agritourism priority, flexible accommodation rules.

4. LEADERSHIP - Seek: planning directors with affordable housing background, supportive commissioners, housing taskforces.

TOP 5 COUNTIES FOR ALTERNATIVE DEVELOPMENT:

KING (WA): Tiny homes with foundations permitted, clear ADU pathway, safety-focused requirements.

TRAVIS (TX): 400 sq ft minimum dwelling, streamlined permitting, rural tourism support.

BROWARD (FL): Container-friendly codes, ADU support under 1,000 sq ft, hurricane-resistant guidelines.

PALM BEACH (FL): Tiny home accessory dwellings allowed, temporary use provisions, clear structure classifications.

HUMBOLDT (CA): Off-grid policies, rural alternative structures allowed, annual inspection program.

Value comes from predictability—clear requirements creating defined development frameworks.The Zoning vs. Comprehensive Plan Opportunity Gap

Here's where things get interesting for early investors. There's often a significant time lag between when a county signals support for alternative housing in its comprehensive plan and when zoning codes actually catch up.

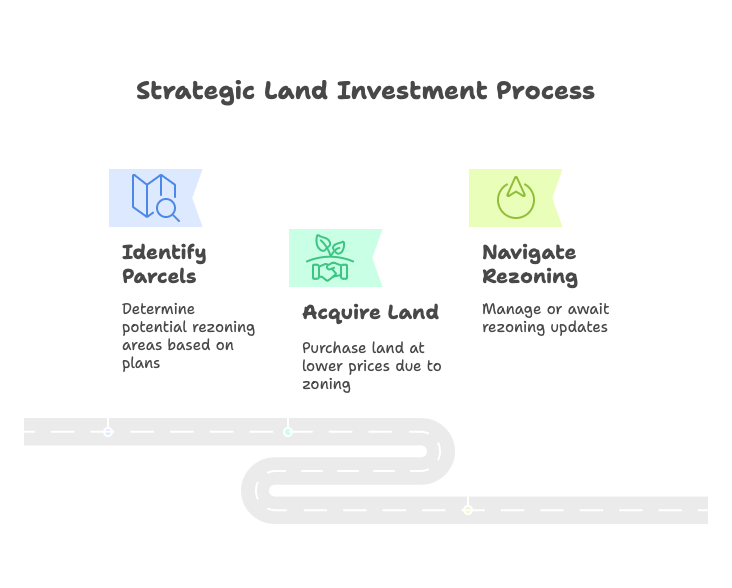

This gap creates a perfect opportunity window for investors who can:

Here's a systematic approach to finding these opportunities:

Step 1: Extract Future Land Use Designations

Start by carefully reviewing the Future Land Use Map (FLUM) in the comprehensive plan. Pay particular attention to areas marked:

"Mixed-Use" or "Mixed Residential"

"Innovation Districts" or "Special Planning Areas"

"Rural Village" or "Rural Activity Center"

"Tourist Commercial" or "Eco-Tourism"

These designations often signal areas where counties intend to allow more diverse development types in the future.

Step 2: Cross-Reference Current Zoning

Now compare those future land use designations with current zoning maps. Look specifically for:

These mismatches between current zoning and future land use designations represent potential investment opportunities.

Step 3: Calculate Time-to-Rezoning

Not all rezoning opportunities are created equal. To assess the likely timeline for regulatory change, consider:

Comprehensive Plan Recency: Recently updated plans (within 2 years) typically see faster implementation

Capital Improvement Schedules: Infrastructure projects often trigger zoning updates

Housing Pressure Metrics: Counties with >5% year-over-year home price increases tend to accelerate housing reforms

Amendment History: Counties with frequent plan amendments move faster than those on rigid 10-year cycles

On average, areas designated "Priority Development" in comprehensive plans see zoning changes within 14-26 months.

Decision Tree: Will This Property Get Rezoned?

Evaluate rezoning likelihood by following these steps:

Is the property's future land use different from current zoning?

No → LOW PROBABILITY

Yes → Continue to next question

Is it within a designated growth area or activity center?

Yes → Check if infrastructure improvements are planned within 3 years

If Yes → HIGH PROBABILITY (12-24 months)

If No → MEDIUM PROBABILITY (24-48 months)

No → Check if the comprehensive plan specifically mentions this area

If Yes → MEDIUM PROBABILITY (24-48 months)

If No → LOW PROBABILITY (48+ months)

This approach helps identify properties with the highest rezoning potential.

Alternative Development Zoning Cheat Sheet

When evaluating zoning codes, these specific designations typically allow various alternative development types:

For Tiny Homes (on foundations):

Residential zones with no minimum square footage requirements

R-1 zones with explicit ADU allowances

"Cottage housing" overlay districts

PUD (Planned Unit Development) zones

For Tiny Homes on Wheels:

RV Park zoning

Campground Commercial

Some agricultural zones with temporary dwelling provisions

"Tiny Home Community" special use districts (emerging in progressive counties)

For Container Structures:

Standard residential zones without architectural review committees

Industrial-transitional zones

Mixed-use zones with form-based codes

Special development districts

For Glamping Developments:

Rural Commercial

Agritourism zones

Recreation/Resort districts

Agricultural with conditional use permits for tourism

The key is understanding that zoning codes are evolving rapidly in this space. Many counties have created special provisions or overlay districts specifically for alternative development that may not fit traditional zoning categories.

Financial Metrics That Matter

The ROI potential for alternative housing developments can significantly outperform traditional development. Here's a comparative analysis based on real-world projects:

Metric | Traditional Development | Alternative Housing |

|---|---|---|

Land Cost Per Unit | $45,000-$75,000 | $10,000-$25,000 |

Construction Cost Per Unit | $175,000-$350,000 | $45,000-$85,000 |

Time to Revenue | 18-36 months | 6-12 months |

Rental Yield | 5-7% | 8-12% |

Sale Markup | 15-25% | 30-45% |

These advantages stem from:

Smaller land footprint per unit

Reduced infrastructure costs

Faster construction timelines

Premium pricing for unique experiences

Let's look at how this plays out in a real-world example:

Case Study: Austin-Area Micro-Community

In 2023, an investor group identified a 5-acre parcel outside Austin, TX zoned agricultural but designated for "innovative rural development" in Travis County's comprehensive plan. Their analysis:

Initial Investment:

Land acquisition: $450,000

Rezoning/entitlement process: $75,000

Infrastructure development: $225,000

Development Approach:

24 tiny home sites (400-600 sq ft each)

Community center and shared amenities

Green infrastructure (solar, rainwater)

Financial Outcomes:

Total project cost: $1.65M ($68,750/unit)

Post-development valuation: $3.2M

ROI: 94% (compared to 35% projected for traditional subdivision)

Time to completion: 11 months (vs. 24+ for traditional)

The key to their success? Reading Travis County's comprehensive plan signals about alternative housing before zoning changes were widely known, then navigating the conditional use permit process rather than waiting for zoning to catch up.

Calculating Your Own ROI Potential

To evaluate specific opportunities, use this template:

Land Efficiency Factor

Traditional: 2-4 units per acre

Alternative: 8-12 units per acre (tiny homes) or 5-8 glamping sites per acre

Infrastructure Cost Ratio

Traditional: $25,000-$45,000 per unit

Alternative: $8,000-$15,000 per unit

Time-to-Revenue Adjustment

For each month faster to market than traditional development, add 0.5% to projected ROI

Premium Experience Multiple

Short-term rental premiums of 25-40% for unique alternative accommodations

This framework allows you to quickly assess whether a specific parcel and development approach is likely to outperform traditional options.

Navigating Common Barriers

While the opportunity is substantial, alternative housing investors face several common regulatory hurdles:

1. Foundation Requirements Over 70% of counties require permanent foundations for tiny homes, eliminating the mobility advantage but often providing longer-term regulatory security.

Solution: Focus on communities with clear "permanent tiny home" provisions rather than fighting for wheeled home approvals.

2. Utility Mandates Most counties require connection to municipal systems when available within certain distances.

Solution: Target properties just beyond mandatory connection distances but within future service areas identified in comprehensive plans.

3. Health Department Regulations Alternative wastewater systems often face additional scrutiny.

Solution: Prioritize counties with established alternative septic or composting toilet guidelines mentioned in comprehensive plans.

4. Fire Code Compliance Especially challenging for clustered developments.

Solution: Build fire code compliance into your site planning from the beginning—counties that mention alternative housing in comprehensive plans typically have worked through these issues.

Your Action Plan

Ready to start finding alternative housing opportunities through comprehensive plans? Here's your step-by-step approach:

Initial Screening: Identify 3-5 counties with population growth in your target region

Plan Review: For each county:

Download the comprehensive plan

Search for "tiny home," "alternative housing," "missing middle," "housing diversity"

Review the Future Land Use Map for flexible designations

Code Analysis: Cross-reference zoning codes with future land use designations to identify gaps

Infrastructure Tracking: Review Capital Improvement Plans for areas getting utility expansions

Opportunity Ranking: Score potential parcels based on:

Current zoning vs. future land use gap

Infrastructure timeline

County's historical pace of implementing plan changes

The investors consistently making 50%+ returns in this space aren't just getting lucky—they're systematically analyzing comprehensive plans to stay ahead of market trends.

Conclusion: The Early Investor Advantage

The alternative housing market presents a remarkable opportunity for investors willing to do their homework. By understanding the signals in comprehensive plans before they manifest in zoning changes, you position yourself ahead of market pricing.

This approach requires more upfront research than traditional development, but the returns speak for themselves: faster time-to-revenue, lower per-unit costs, and significantly higher margins in an increasingly competitive housing market.

In our next article, we'll explore how to extract even more value by tracking comprehensive plan amendments and updates—often the earliest possible signal of emerging investment opportunities.

Next in the series: "Plan Amendments and Updates: Catching Investment Opportunities at Their Earliest Stage"

Psst…Want access to action plans, workbooks, sample scripts and more? Our PRO content offers you everything you need to take action on these strategies and make more money in your business. Subscribe using this link and get 25% off for life!

IMPLEMENTATION

AROUND THE HORN

New & Updates

This regulatory change creates substantial investment potential in West Sacramento by:

Allowing property owners to place tiny homes on wheels on their land, creating new rental income streams

Opening opportunities for developers to create tiny home communities with significantly lower development costs

Eliminating the previously required permanent foundation, reducing construction expenses and increasing flexibility

Responding to increasing demand for affordable housing options in California's tight housing market

Key investor implications include:

Transit-Oriented Development (TOD) Overrides: Automatic zoning upgrades to RM-3 (multi-family residential) within 1/4 mile of planned electric bus corridors

Rural Innovation Districts: New designation allowing mixed-use commercial/residential parcels under 5 acres with reduced parking requirements

Micro-Utility Incentives: Priority permitting for developments incorporating shared wastewater systems servicing 4-10 tiny home units

The plan's housing needs assessment identifies a 78% deficiency in sub-$300k housing units, creating strong municipal receptivity to manufactured home communities meeting Energy Star certification standards.

"The desire for carnal possession quickly cools, whereas the desire to own land never quits the heart of man." - Gabriel Chevallier