INTRODUCTION

Hey land lovers,

This week we're diving into what many veteran investors call the "crystal ball" of land appreciation: infrastructure expansion plans. With a little research, investors can create giant returns simply by knowing where water and sewer lines will flow next.

Our third installment in the Comprehensive Plan series breaks down exactly how to decode county growth plans and infrastructure elements hidden within comprehensive planning documents. These publicly available resources effectively telegraph where development potential will multiply in the coming years, creating a roadmap to value appreciation that few investors ever discover.

Whether you're seeking raw land opportunities with explosive upside or looking to time your entry into transitioning markets, this week's methodology gives you the systematic approach to track infrastructure projects, verify their funding status, and calculate the "infrastructure premium" for properties in the impact zone. After all, the most successful land investors aren't just buying great properties—they're acquiring tomorrow's development hotspots while others are still wondering where growth will happen next.

Cheers,

Sean

IDEA

Infrastructure & Utilities: The Hidden Development Timeline

Last week's exploration of alternative housing opportunities hopefully sparked some valuable ideas. This week's focus shifts to what many experienced investors consider the most reliable wealth-creation strategy in land investing: leveraging comprehensive plans to predict infrastructure expansion.

This strategy doesn't rely on speculation or market timing. Instead, it's about understanding where water, sewer, and utility expansions are headed before the broader market recognizes the opportunity.

3rd in a four-part series on leveraging county planning documents for profitable land investments

Why Give a Hoot?

When utilities expand into previously unserved areas, land values don't just increase incrementally—they often multiply dramatically. This transformation happens because infrastructure fundamentally changes what's possible on a property, opening development potential that simply didn't exist before.

Consider this real-world example from the investor community:

An investor noticed his county's comprehensive plan mentioned a rural area slated for "urbanization" in the 10-year outlook. Digging into the Capital Improvement Plan, he discovered that sewer lines were funded and scheduled to extend there within 3 years. He purchased a 5-acre parcel for $85,000 that could only support one home because of septic requirements. Three years later, after the sewer installation was completed, he sold to a developer for $375,000, who built 12 homes on the site—a 341% return simply from being ahead of the infrastructure curve.

This wasn't luck or perfect timing—it was understanding information that was publicly available but that most investors never examine.

Finding the Gold in Infrastructure Plans

Years of research reveal where counties typically house their infrastructure plans. Here's where to look:

Key Documents to Target:

Capital Improvement Plans (CIPs): These 5-10 year strategic plans are the treasure maps, detailing exactly what the county plans to build, when they plan to build it, and most importantly—how they'll pay for it.

Infrastructure Elements: Sometimes labeled as "Public Facilities Elements" or "Transportation Elements" depending on the jurisdiction.

Implementation Strategy Tables: Usually toward the end of comprehensive plans, these tables show timeframes and priorities for all planned projects.

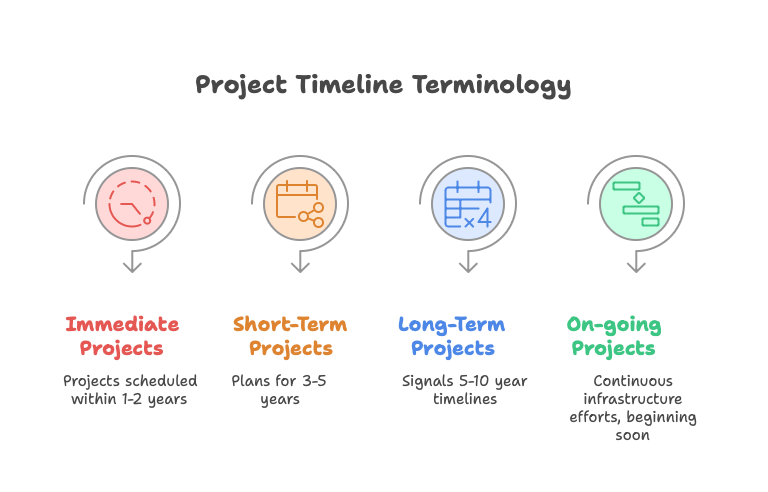

Decoding the Timeline Language

Counties use consistent terminology that reveals implementation timelines:

Pro tip: Look for the intersection of "High Priority" with "Immediate" or "Short-Term" implementation. These projects represent the best opportunities for near-term value appreciation.

The Infrastructure Types That Drive Value

Not all infrastructure improvements impact land values equally. Based on extensive research and market results, here are the most significant value drivers:

1. Water and Sewer Extensions

This is the ultimate value multiplier, especially for raw land. When property transitions from septic-dependent to sewer-serviced, development potential changes dramatically. Parcels often increase 5-10x in value when this switch happens because they can suddenly support much higher density development.

2. Fiber Broadband Infrastructure

In today's market, high-speed internet isn't optional—it's essential. Studies have found that fiber availability increases property values significantly, comparable to having amenities like air conditioning or a pool.

This impact is especially powerful in rural areas that are in transition. The ability to work remotely from a rural property dramatically changes its market appeal and potential uses.

3. Transportation Improvements

New roads, improved intersections, and transit corridors act as development magnets. When access improves, commercial and residential interest follows.

The impact varies by project type, but transportation improvements consistently signal incoming development waves and corresponding value increases.

Distinguishing Real Projects from Wishful Thinking

Not everything in a comprehensive plan actually happens. Some elements are more aspirational than operational. Here's how to distinguish between real projects and pipe dreams:

High-Confidence Signal Indicators:

Explicit mention of secured funding sources

References to approved bonds or tax measures

Inclusion in current fiscal year budgets

Formal agreements with state/federal agencies

Specific implementation dates rather than vague timeframes

Multiple indicators from this list suggest a project has strong probability of moving forward on schedule.

Building an Infrastructure Tracking System

Successful investors develop systematic approaches to monitoring infrastructure developments. Here's an effective system anyone can implement:

Start with a County Portfolio: Select 3-5 counties of interest and download their comprehensive plans and CIPs.

Create a Tracking Sheet: Use a spreadsheet with columns for:

Project name

Infrastructure type

Timeline classification

Priority level

Funding status

Estimated completion date

Properties potentially impacted

Map the Findings: Overlay these projects on a county map to visualize "hot zones" where multiple infrastructure improvements converge.

Verify Through Multiple Channels: Never rely solely on written plans. Verification should include:

Contacting the county planning department

Checking with utility companies directly

Attending public information sessions for major projects

Looking for construction permits being filed in the area

A Proven Process for Capitalizing on Infrastructure

When a promising infrastructure project is identified, successful investors follow this process:

This Week's Action Steps

Here are three actionable steps to start leveraging this strategy immediately:

Download the CIP: Get the Capital Improvement Plan for your target county and highlight all water, sewer, and broadband projects.

Make Two Phone Calls: Contact your county's planning department and public works department to ask about funded infrastructure projects in the next 3-5 years.

Start Your Tracking Sheet: Use the template included below to begin organizing your infrastructure intelligence.

Coming Next Week

Next week's newsletter will explore economic incentive zones and how to strategically participate in the comprehensive planning process to potentially influence infrastructure decisions in favorable ways.

Psst…Want access to action plans, workbooks, sample scripts and more? Our PRO content offers you everything you need to take action on these strategies and make more money in your business. Subscribe using this link and get 25% off for life!

IMPLEMENTATION

AROUND THE HORN

New & Updates

These regulatory clarifications remove previous ambiguity that deterred investment in tiny home communities. With defined parameters for utilities, waste disposal, and minimum square footage, developers now have a clear roadmap for compliance.

Potential benefits: Land investors can now consider previously overlooked parcels for tiny home community development, particularly in counties with newly formalized regulations. The average cost of custom-built tiny homes ranges from $50,000 to $100,000+, suggesting attractive profit margins for developers who can create legally compliant communities.

The updated regulations replace a previous moratorium on new RV park developments that had been in place since June 2024 and extended through March 2025. The new framework provides certainty and multiple pathways for approval.

Potential benefits: Developers now have expanded opportunities to create RV parks in different zoning districts, with clearer operational requirements and alternatives for sites with challenging road access. The ordinance also addresses long-term residency within RV parks, allowing permanent residency subject to local property taxes, which could create more stable revenue streams for park owners.

"Don’t wait to buy real estate. Buy real estate and wait." - Will Rogers