INTRODUCTION

Welcome back!

This week we're venturing into the mathematical poetry of minor subdivisions—a strategy that can massively increase the value of a piece of land without so much as a shovel. We’re here today to dissect this elegant arbitrage opportunity.

Explore this week's newsletter and discover why sometimes the most valuable development tool isn't a bulldozer—it's a surveyor's pen.

This is gonna be a hoot.

Happy investing,

Sean

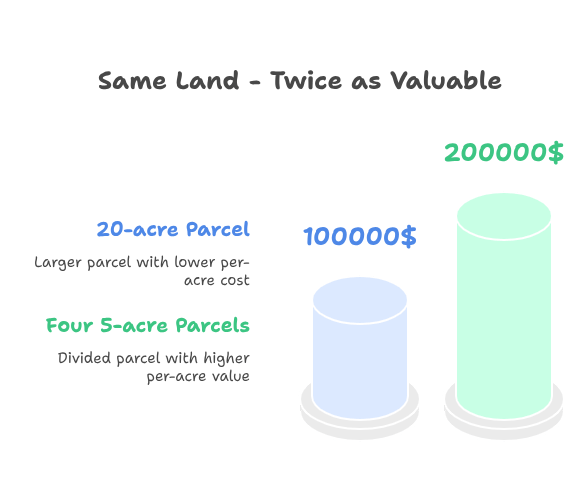

There's an elegant mathematical proposition that savvy land investors have discovered: transforming a single $100,000 parcel into three $60,000 lots in under six months, without navigating the labyrinthine complexity of major infrastructure or traditional development processes. This alchemy—turning one thing into many more valuable things—sits at the heart of what may be real estate's most elegant yet accessible investment strategy: plat-exempt subdivisions.

The Hidden Opportunity in Plain Sight

While most real estate investors crowd the familiar territories of residential flips and rental portfolios, a more discerning cohort has discovered that sometimes the most significant value creation occurs through the simple reconfiguration of property lines. The beauty here isn't in physical transformation but in regulatory navigation—a realm where knowledge creates immediate equity.

Think of it as arbitrage in its purest form: not temporal or geographical, but dimensional. The same land, reconstituted into smaller parcels, suddenly commands a premium that defies conventional valuation models.

Understanding the Price-Per-Acre Differential

This strategy works because of a fascinating market inefficiency: the price-per-acre differential across parcel sizes. Consider this principle in action:

A 20-acre parcel might sell for $5,000 per acre ($100,000 total)

In the same market, 5-acre parcels might command $10,000 per acre ($50,000 each)

By purchasing the larger parcel and dividing it into four 5-acre lots, you've potentially created $200,000 in value from a $100,000 investment

This isn't speculative theory—it's observable market behavior. Smaller parcels typically command premium pricing because they're more accessible to a broader buyer pool, satisfy the "just enough land" desire of many rural and suburban buyers, require less maintenance, and often have fewer restrictions than larger agricultural parcels.

The Regulatory Advantage of Minor Subdivisions

Traditional subdivision development demands patience measured in years, capital measured in millions, and bureaucratic fortitude measured in gray hairs. Between planning commissions, engineering requirements, and infrastructure development, major subdivisions represent a substantial business undertaking with proportional risks.

Minor subdivisions—often called "plat-exempt" or "administrative" subdivisions—offer a more refined approach. These regulatory pathways typically allow:

The Practical Implementation Path

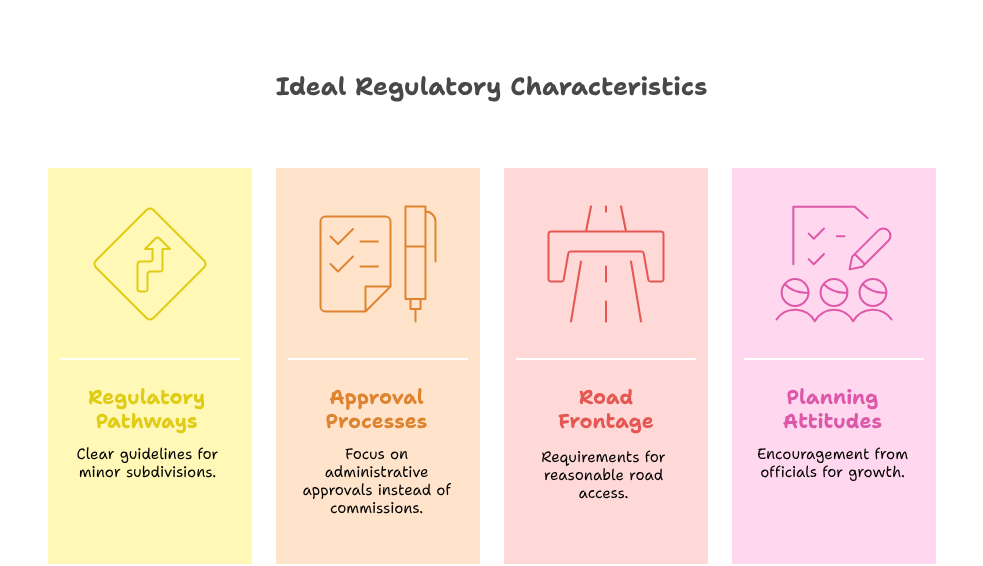

For those intrigued by this strategy, the journey begins not with property acquisition but with jurisdiction analysis. Not all counties and municipalities offer equally favorable pathways for minor subdivisions.

The most advantageous territories typically share these characteristics:

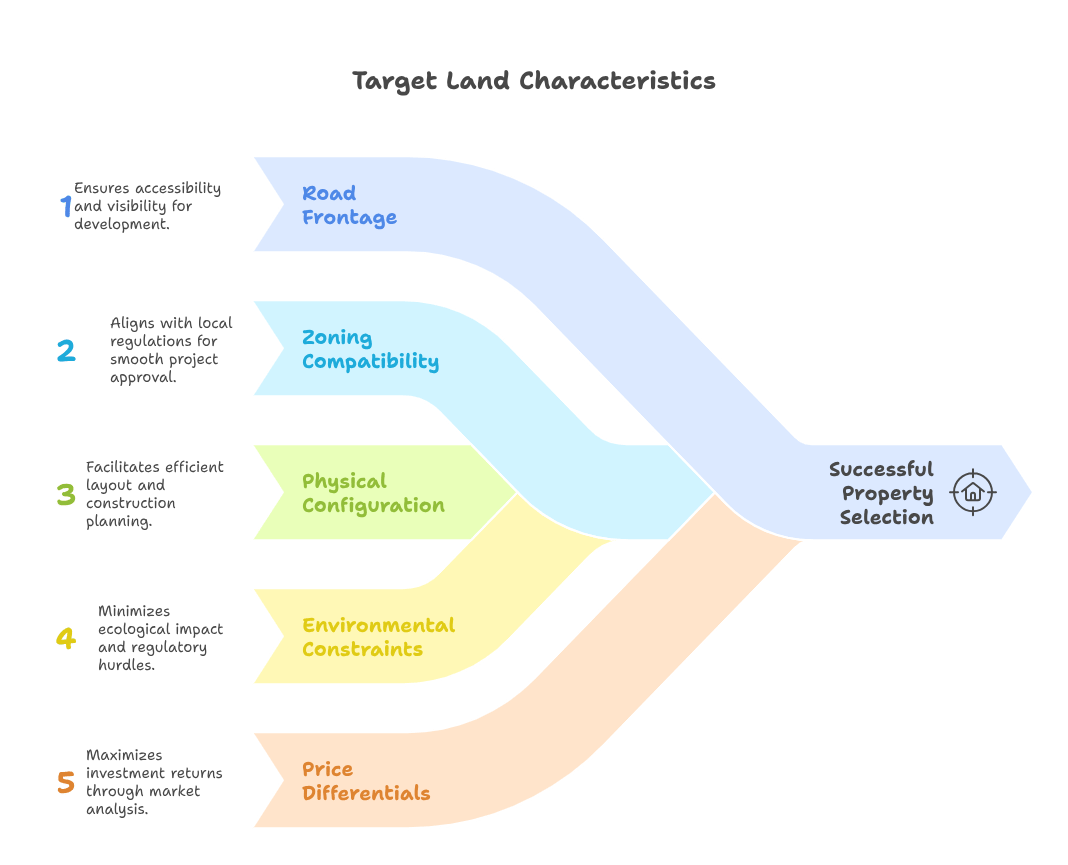

Once a favorable jurisdiction is identified, property selection focuses on suitable candidates with:

The Investment Case: Risk-Adjusted Returns

Consider this simple example:

Acquisition: 20-acre parcel purchased for $100,000 ($5,000/acre) Subdivision Costs: Approximately $20,000 for survey, application fees, legal work, and minimal utility extensions Total Investment: $120,000

Revenue: Four 5-acre lots sold at $50,000 each ($10,000/acre): $200,000 Net Proceeds (after selling costs): $186,000 Profit: $66,000 (55% ROI) Timeline: 6 months from purchase to final sale

This represents a strategy that delivers development-level returns with dramatically reduced complexity, time horizon, and risk profile.

Where Strategy Meets Opportunity

The most elegant aspect of lot-splitting is that it doesn't require distressed sellers, negotiation leverage, or market timing. You can often purchase land at full market value and still generate substantial returns through strategic subdivision, provided you've identified markets with meaningful price-per-acre differentials between larger and smaller parcels. This approach allows you to create immediate value without requiring physical transformation of the asset itself.

AROUND THE HORN

New & Updates

Why to Give a Hoot: This bill (not yet passed) represents a significant shift in development regulations that would benefit land investors by reducing local government restrictions, creating by-right density minimums, limiting costly design standards, providing legal recourse against perceived arbitrary denials, and potentially accelerating approval timelines.

Why to Give a Hoot: By allowing tiny homes on wheels (THOW) as permanent residences, the county is opening the door for investors to create small tiny home developments in medium density zones, areas typically with high demand. It allows grouping of THOWs in the Medium Density Residential (R2) Zoning District, supporting up to 6 units per acre with a development permit.

"Buy land, they're not making it anymore."