INTRODUCTION

Hey land enthusiasts!

This week we're exploring the profitable world of tiny home communities - an increasingly popular tool for addressing the housing shortage and a solid approach to maximizing returns on vacant land. Our featured articles break down the basics and provide a detailed implementation guide for those ready to dive deeper.

Could thinking small lead to your next big opportunity? Explore this week's newsletter to find out.

Happy investing,

Sean

IDEA

Tiny Home Communities: Small Houses, Big Opportunity

ESCAPE Tiny Home Village - Tampa

Welcome to the world of tiny home communities – where thinking small could lead to oversized returns.

Why Give a Hoot?

Tiny home communities represent a fascinating intersection of affordable housing, sustainable living, and smart land use. These developments feature multiple small dwellings (typically under 600 square feet) situated together on a shared parcel of land.

The Right Fit

This strategy works best for investors with:

Vacant land in areas with housing shortages

Property near tourist destinations or natural attractions

Land that's challenging to develop with traditional housing

A desire for steady monthly income rather than one-time profits

Quick-Start Success Factors

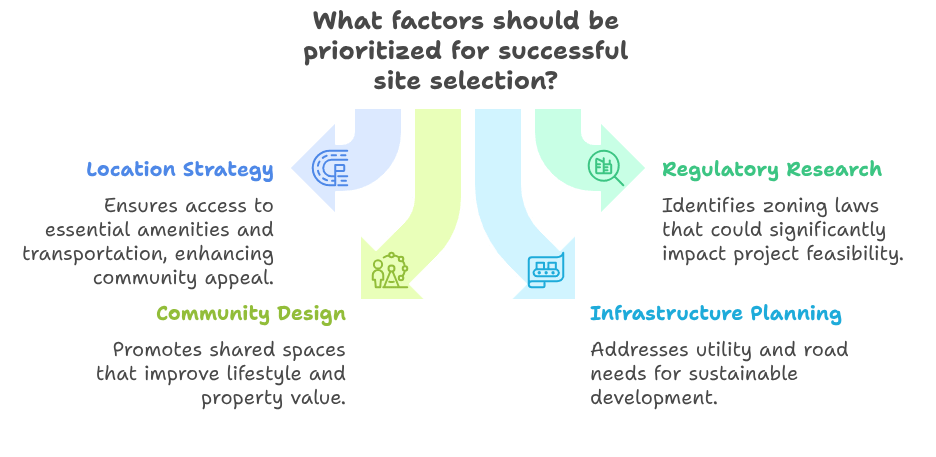

Location Strategy: Select sites with access to amenities, employment, and transportation

Regulatory Research: Investigate local zoning laws (the make-or-break factor)

Community Design: Include shared spaces that enhance lifestyle and value

Infrastructure Planning: Consider utilities, roads, and communal facilities

Smart investors are recognizing that tiny homes aren't just a trend – they're an innovative solution to housing challenges that can transform vacant land into thriving, profitable communities.

Psst…Want to dive deeper into the nuts and bolts of developing tiny home communities? Our Pro content explores the detailed roadmap from concept to completion, including regulatory navigation, financing strategies, and maximizing your ROI.

**For this issue we are offering FREE access to our Pro content along with an early bird special for new Pro subscribers. Use this link to get 25% off your annual subscription and lock that price in for life!

IMPLEMENTATION [PREMIUM SUBSCRIPTION CONTENT PREVIEW]

Tiny Home Communities: The Land Investor's Complete Implementation Guide

Welcome to the Future of Profitable Land Development

Picture this: Instead of selling one piece of land for a single profit, you're collecting monthly checks from multiple tiny homes on that same piece of property. Or perhaps you're selling individual tiny homes for $60K-$100K each on lots that cost you a fraction of traditional development. This isn't just a theory – it's happening across the country for savvy land investors who've cracked the tiny home community code.

The Market Opportunity: Why Tiny Homes Are Creating Massive Returns

The tiny home movement isn't just some hippie fad – it's a response to real economic and social pressures creating an extraordinary opportunity for land investors:

Housing affordability has reached crisis levels in many markets

Millennials and downsizing Baby Boomers are embracing minimalist living

Remote work has freed people to live where they want, not where they must

Environmental consciousness is driving smaller footprint living

Experiences are valued over possessions by today's home buyers

These factors have created a perfect storm for land investors willing to think outside the traditional development box.

Tiny Home Community Models: Pick Your Profit Path

Before diving into implementation, you'll need to decide which model aligns with your investment goals:

1. The Rental Community

You maintain ownership of the land and homes, generating steady monthly income through long-term leases or lucrative short-term rentals.

Profit Potential: $1,000-$2,500/month per unit with 80%+ occupancy rates in prime locations

2. The For-Sale Development

You subdivide land, install infrastructure, and sell individual tiny homes with land, creating a fast capital return.

Profit Potential: 30-50% ROI within 12-18 months in strong markets

3. The Hybrid Approach

Sell some units outright for immediate capital return while retaining others for long-term income.

Profit Potential: Balance of upfront cash and ongoing passive income

4. The Social Impact Investment

Partner with nonprofits or government agencies to create affordable housing while securing tax benefits and potentially guaranteed income.

Profit Potential: Lower overall returns but steadier income and significant tax advantages

The Critical Path: From Raw Land to Revenue

Let's break down the process step-by-step:

Phase 1: Strategic Site Selection

Your site will make or break your project. Look for these characteristics:

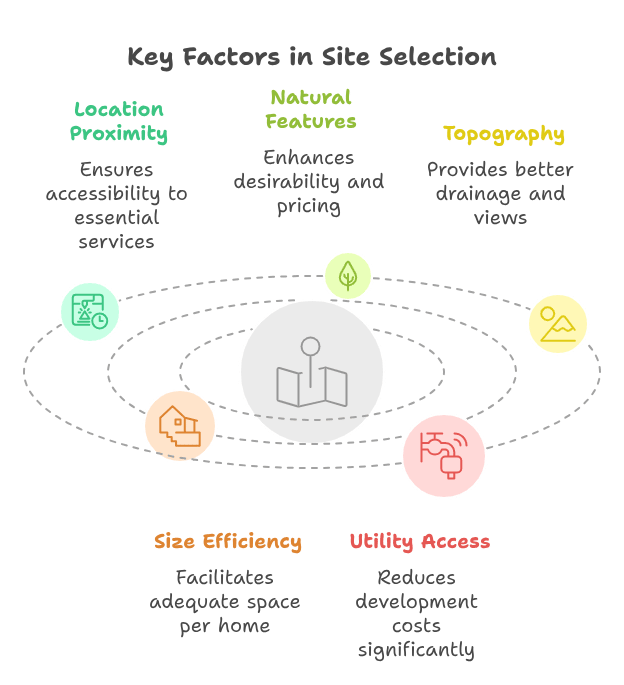

Location Proximity: Within 30 minutes of employment centers, grocery stores, and basic services

Natural Features: Trees, views, or water features greatly enhance desirability and pricing

Topography: Gently sloping land provides better drainage and view opportunities

Size Efficiency: Aim for at least 1/4 acre per home including common spaces

Utility Access: Water, sewer, and electrical access dramatically reduce development costs

Land Acquisition Tip: Land zoned for manufactured homes or RVs often offers an easier path to approval than traditional residential zoning.

Phase 2: Navigating the Regulatory Maze

This is where most wannabe tiny home developers get stuck. Here's your roadmap:

The Zoning Challenge

Many jurisdictions haven't updated their codes for tiny homes. You have three primary options:

Find Friendly Territory: Some municipalities have already adopted tiny home-friendly codes

Pursue Variance/Special Use Permits: Present a compelling case for your specific site

Request Code Amendments: A longer process but creates lasting value

Pro Strategy: Start by researching the specific minimum dwelling size requirements in your target area. Some places have minimum sizes as low as 150 sq ft, while others require 600+ sq ft.

Building Code Compliance

Tiny homes must generally comply with one of three standards:

HUD Code: For manufactured homes

International Residential Code: For permanent dwellings (IRC Appendix Q specifically addresses tiny homes)

ANSI Standards: For recreational vehicles (temporary occupancy only)

Implementation Hack: Partner with tiny home builders who have pre-approved designs that meet local requirements.

Phase 3: Community Design & Infrastructure Development

This is where you create the value that will separate your development from just a collection of small houses:

Community Features That Boost Value

The most successful tiny home communities include:

Community Building: Shared kitchen, laundry, or workspace

Outdoor Gathering Spaces: Fire pits, BBQ areas, seating

Green Spaces: Community gardens, walking paths, natural areas

Storage Solutions: Additional storage options beyond the tiny homes

Value-Add Tip: Each dollar spent on thoughtful community amenities typically returns $3-5 in increased home values or rental rates.

Phase 4: Financial Modeling & Funding

Here's where the rubber meets the road – making sure your project pencils out:

Sample Development Budget (10-Unit Community)

Land acquisition: $100,000-$300,000

Site prep & infrastructure: $150,000-$250,000

Tiny homes (400 sq ft @ $150/sq ft): $600,000

Community amenities: $50,000-$100,000

Soft costs (permits, design, legal): $50,000-$75,000

Total investment: $950,000-$1,325,000

Funding Sources

Traditional Banks: Increasingly open to tiny home projects with proven models

Private Investors: 12-18% returns attract private capital

Owner Financing: Particularly for the land portion

Crowdfunding: Works well for eco-focused or social impact projects

Pre-sales: Using reservations to fund construction

Financing Tip: Package your deal as a "small home community" rather than "tiny homes" when approaching traditional lenders.

Enjoying this deep dive? Sign up now with this link for 25% off for life!

Phase 5: Marketing & Resident Selection

The right residents make all the difference in community success:

Target Market Identification

Successful communities focus on specific demographics:

Young professionals (25-35)

Empty nesters (55+)

Outdoor enthusiasts

Sustainable living advocates

Remote workers

Marketing Strategies That Work

Virtual Tours: 3D walkthroughs of homes and community

Lifestyle Marketing: Focus on the tiny home lifestyle, not just the property

Social Media Targeting: Highly effective for reaching tiny home enthusiasts

Short-term Rental Strategy: Let potential buyers "try before they buy"

Profit-Boosting Strategy: Creating an Instagram-worthy community space will generate free marketing as residents share their experience.

Implementation Timeline: What to Expect

A realistic timeline helps manage expectations and cash flow:

Months 1-3: Site selection, due diligence, preliminary design

Months 3-6: Entitlements, permitting, and regulatory approval

Months 6-9: Infrastructure development

Months 9-12: Home installation and community features

Months 12+: Occupancy and ongoing management

Case Study: Tiny Home Village

A 12-acre parcel in Western NC was purchased for $175,000. Previously zoned agricultural, the developer secured special use permits for a "cottage housing development" with 24 tiny homes on 6 acres, leaving 6 acres as preserved natural space.

Total Development Cost: $1.2 million ($50,000 per unit all-in)

Sales Structure: 15 homes sold at $110,000 each, 9 retained as rentals

Rental Income: $1,200/month per unit ($129,600 annual gross income)

Return on Investment: 42% on the sold portion, ongoing 13% cap rate on rentals

Time to Completion: 14 months from land purchase to first occupancy

Potential Challenges & Solutions

Be prepared for these common hurdles:

Challenge 1: Regulatory Resistance

Solution: Start with pre-application meetings to identify concerns early; be prepared to educate officials about successful models elsewhere.

Challenge 2: NIMBYism

Solution: Host community information sessions showcasing high-quality designs and addressing property value concerns with data.

Challenge 3: Financing Hurdles

Solution: Break the project into phases, using profits from early phases to fund later development.

Challenge 4: Infrastructure Costs

Solution: Consider alternative systems like composting toilets, rainwater harvesting, and solar power to reduce utility extension costs.

Your Action Plan: Next Steps to Launch Your Tiny Home Community

The Bottom Line: Is This Strategy Right for You?

Tiny home communities represent a unique opportunity to:

Extract higher per-acre value from land

Create faster returns than traditional development

Generate both immediate and long-term income streams

Build a recession-resistant investment (affordable housing remains in demand)

While not without challenges, the combined forces of housing affordability issues, changing demographics, and sustainability concerns suggest the tiny home movement has staying power. For land investors willing to pioneer this approach, the rewards can be substantial – proving that sometimes thinking small is the biggest idea of all.

Implementation Checklist:

[ ] Research local zoning and building codes

[ ] Identify potential sites with appropriate infrastructure access

[ ] Create preliminary community layout and amenity plan

[ ] Develop detailed financial projections

[ ] Consult with land use attorney regarding regulatory strategy

[ ] Establish relationships with tiny home builders or manufacturers

[ ] Create marketing materials emphasizing lifestyle and community

[ ] Develop resident selection criteria and application process

[ ] Plan for ongoing management and maintenance

Remember: The most successful tiny home communities don't just sell square footage – they sell a lifestyle, community, and simplified way of living that increasingly appeals to today's home buyers and renters.

Want access to action plans like this every week covering detailed strategies to help you succeed with land investing and unique development? Upgrade to Pro with this link to lock in our early bird discount of 25% off for life!

AROUND THE HORN

New & Updates

With permission for up to two accessory dwelling units per single-family lot, investors can immediately add rental income streams to existing properties. Think "house-hacking on steroids" with multiple units on one lot.

The two-acre maximum lot size restriction means previously "undevelopable" large parcels can now be divided into multiple buildable lots, instantly multiplying property values.

Commercial zones are now excellent development prospects. By incorporating ground-floor retail with residential above, developers can tap into the growing market for walkable, live-work-play communities.

Arizona just greenlit backyard casitas, multi-unit buildings near business districts, and the game-changing "Starter Homes" legislation for smaller houses on smaller lots. Translation? You can now build what actual humans can afford.

"Land really is the best art." - Andy Warhol