INTRODUCTION

Hey land investing connoisseurs!

This week we're diving deep into the art of systematic opportunity identification—the skill that separates professionals generating 15-30% annual returns from those chasing overpriced, widely-marketed properties.

While most investors rely on basic comparable sales and obvious listings, the pros are quietly engineering deals through methodical analysis of market inefficiencies, hidden value drivers, and regulatory mismatches. They're not hunting for deals—they're creating them by spotting what others overlook.

Our latest installment reveals the four-pillar framework for identifying undervalued parcels with significant value-add potential, complete with the professional data stack and due diligence protocols that consistently uncover hidden gems trading at substantial discounts to their true potential.

From zoning arbitrage opportunities to infrastructure timeline advantages, this systematic approach to land analysis is how smart money consistently finds properties that deliver exceptional returns while others compete for the same overpriced inventory.

Ready to engineer your next high-potential acquisition? Let’s get started!

Cheers,

Sean

IDEA

Unlocking Hidden Gems: How to Spot High-Potential Land Investments

Why Give a Hoot?

Here's what separates successful land investors from the rest: they don't hunt for deals—they engineer them through methodical analysis of market inefficiencies, hidden value drivers, and overlooked opportunities. While most investors chase the same widely-marketed properties, the pros are quietly acquiring hidden gems at substantial discounts.

Consider this recent example from our network:

An investor identified a 12-acre parcel listed at $480,000—seemingly unremarkable industrial land in a secondary market. Through systematic analysis, she discovered the property sat directly adjacent to a planned $200M logistics hub (buried in municipal meeting minutes), qualified for three separate tax abatement programs, and could be subdivided into premium commercial lots. Total acquisition and improvement cost: $650,000. Current appraised value after 18 months: $1.8M. That's a 177% return through systematic opportunity identification.

This wasn't luck or insider information. Every insight came from publicly available data that 99% of investors never analyze.

The Hidden Inefficiencies in Land Markets

Land markets operate with far more inefficiencies than other real estate sectors, creating systematic opportunities for informed investors. Unlike residential or commercial properties with standardized valuation methods, land value depends on complex interactions between zoning, infrastructure, market timing, and regulatory changes that most market participants don't fully understand.

The primary inefficiencies fall into four categories:

Information Asymmetries: Critical value drivers often exist in government records, planning documents, and infrastructure databases that aren't integrated into standard listing platforms.

Pricing Disconnects: Properties frequently trade based on current use rather than highest and best use, creating arbitrage opportunities for investors who understand development potential.

Timing Mismatches: Value catalysts like infrastructure projects or zoning changes often have 2-5 year lead times, but most sellers price properties based on current conditions.

Analytical Gaps: Few market participants conduct comprehensive financial analysis that accounts for all potential value-add strategies, regulatory benefits, and market timing factors.

The Four Pillars of Value-Add Land Investment

Through extensive analysis of high-performing land investments, four pillars consistently determine success:

1. Location Intelligence: Beyond the Obvious

The most successful land investors develop proprietary location scoring systems that go far beyond traditional "location, location, location" thinking.

Growth Corridor Analysis: Identify properties positioned along emerging growth paths before they become obvious to the market. This requires analyzing population migration patterns, employment growth projections, and planned infrastructure development through multiple data sources.

Key indicators: New highway interchanges, public transit extensions, major employer relocations, utility infrastructure upgrades, and planned community amenities.

Demographic Arbitrage: Target areas where demographic shifts are creating demand for land uses that current zoning and pricing don't reflect. Young professional migration to previously industrial areas, family formation in urban cores, and aging population service needs all create predictable land use evolution.

Infrastructure Anticipation: Monitor planned infrastructure improvements through municipal capital improvement plans, state transportation budgets, and utility expansion programs. Properties benefiting from future infrastructure often trade at discounts to their post-improvement value.

2. Zoning and Regulatory Opportunity Identification

Regulatory mismatches create some of the highest-return opportunities in land investment, but require sophisticated analysis to identify and execute.

Zoning Variance Potential: Properties currently zoned for lower-value uses but suitable for higher-value development represent classic arbitrage opportunities. Success requires understanding both the technical requirements for zoning changes and the political dynamics that influence approval decisions.

Entitlement Acceleration: Properties where you can secure development entitlements significantly faster than competitors create timing advantages that translate into superior returns. This might involve pre-approved development plans, expedited review processes, or simplified approval pathways.

Regulatory Timeline Arbitrage: Changes to zoning ordinances, comprehensive plans, and development standards often have predictable implementation timelines. Properties affected by favorable regulatory changes often trade at discounts during the uncertainty period before new rules take effect.

3. Financial Analysis Beyond Simple Comparables

Most land investors rely on oversimplified comparable sales analysis that misses critical value drivers and risk factors.

Highest and Best Use Modeling: Systematically evaluate multiple development scenarios for each property, including phased development strategies, different market timing assumptions, and various exit strategies.

Value-Add Improvement Analysis: Calculate specific returns for different improvement strategies: utility extensions typically generate 3-5x returns on investment, access improvements often yield 2-4x returns, and environmental remediation can provide 4-8x returns when properly executed.

Holding Period Optimization: Model various holding periods and improvement timelines to identify optimal acquisition and disposition timing. Many investors underestimate holding costs or over-estimate improvement timelines, leading to inadequate returns.

4. Due Diligence That Uncovers Hidden Value

Professional-grade due diligence often reveals value opportunities that aren't apparent from basic property information.

Utility Capacity Analysis: Verify not just utility availability but system capacity to support intended development. Properties with existing utility capacity often provide significant advantages over parcels requiring system upgrades.

Environmental Opportunity Assessment: Environmental constraints that appear problematic to most investors sometimes create opportunities for specialists. Wetland mitigation banking, conservation easement strategies, and environmental remediation programs can generate substantial returns.

Access and Assembly Potential: Evaluate opportunities to improve property access or assemble adjacent parcels. Properties with inferior access often trade at substantial discounts that can be eliminated through strategic improvements or acquisitions.

The Professional Investor's Data Stack

Successful land investors rely on data sources and analytical tools that go far beyond standard MLS systems:

Primary Research Platforms

Government and Public Records

Municipal Planning Departments: Comprehensive plans, zoning variance histories, capital improvement programs, and development application databases provide critical intelligence about future development patterns and regulatory changes.

Property Tax Assessment Records: Often reveal pricing disconnects between assessed values and market conditions, while providing insights into improvement values and potential tax strategies.

Infrastructure Planning Agencies: State and regional transportation departments, utility commissions, and economic development authorities publish planning documents that reveal future infrastructure investments.

Advanced Analytics Integration

Satellite Imagery and Aerial Photography: Monitor development activity, assess property conditions, and identify environmental constraints without site visits. Particularly valuable for tracking market trends across broad geographic areas.

Demographic and Economic Databases: Census data, employment statistics, migration patterns, and economic forecasts provide context for evaluating long-term value drivers and market demand.

Due Diligence That Actually Matters

Most investors conduct inadequate due diligence that misses critical risk factors and value opportunities:

Environmental Intelligence Beyond Phase I

Wetland Delineation: Conduct preliminary wetland assessment even for properties without obvious environmental constraints. Wetland impacts can consume 20-40% of development area and trigger extensive regulatory processes.

Soil and Geological Analysis: Understand soil conditions, slope stability, and drainage characteristics that impact development costs and feasibility. Poor soil conditions can add $50,000-$200,000 to development costs.

Contamination Risk Assessment: Evaluate potential contamination sources including underground storage tanks, dry cleaners, gas stations, and industrial operations within 1/4 mile radius.

Infrastructure Capacity Analysis

Utility System Evaluation: Verify not just service availability but system capacity to support intended development intensity. Many properties require expensive utility upgrades that aren't apparent during basic due diligence.

Transportation Impact Assessment: Understand traffic generation from planned development and potential requirements for roadway improvements or traffic mitigation measures.

Stormwater Management Requirements: Calculate area requirements and costs for stormwater detention, which can consume 5-15% of developable area and cost $25,000-$100,000 per acre.

Regulatory Risk and Opportunity Assessment

Market Intelligence That Creates Competitive Advantage

Infrastructure Project Monitoring

Systematic tracking of planned infrastructure improvements provides 2-5 year advance notice of value catalysts:

Transportation Infrastructure: Highway construction, public transit expansion, and airport improvements create accessibility benefits that increase land values by 20-50% within 2-3 years of completion.

Utility Infrastructure: Water, sewer, and electrical system expansions enable development in previously constrained areas, often creating 3-10x value increases for raw land.

Community Infrastructure: School construction, healthcare facilities, and recreational amenities create quality of life improvements that drive residential demand and land value appreciation.

Demographic Shift Analysis

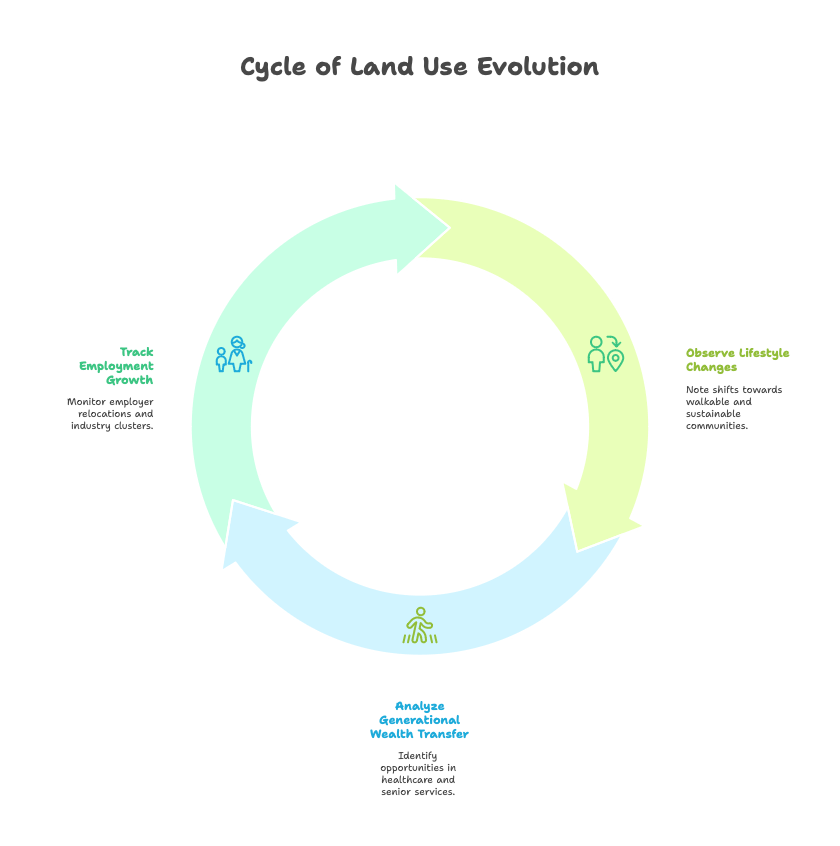

Population and economic trends create predictable land use evolution:

Financial Modeling for Maximum Returns

Value-Add Improvement Analysis

Different improvement strategies generate predictable return multiples:

Utility Extensions: $50,000-$150,000 per mile typically generates 3-5x returns through enabled development valueAccess Improvements: $25,000-$100,000 investments often yield 2-4x returns by eliminating access constraintsEnvironmental Remediation: $75,000-$300,000 remediation costs can generate 4-8x returns when properly executedEntitlement Acquisition: $100,000-$500,000 entitlement costs typically provide 2-6x returns through development rights value

Risk-Adjusted Return Calculations

Professional investors apply sophisticated risk adjustments that account for:

Market Risk: 15-25% probability adjustments for demand changes, pricing volatility, and absorption rate variationsRegulatory Risk: 10-30% probability adjustments for approval delays, requirement changes, and political oppositionEnvironmental Risk: 20-40% contingency reserves for unexpected contamination, wetland impacts, or geological issuesFinancial Risk: Interest rate sensitivity analysis and financing availability scenarios

This Week's Action Plan

Here are five immediate steps to start identifying value-add opportunities:

1. Establish Your Market Intelligence System

Set up automated monitoring for:

Municipal planning department meeting agendas and minutes

State transportation improvement program updates

Economic development authority announcements

Zoning variance application filings

2. Build Your Professional Network

Identify and connect with:

Municipal planners and economic development officers

Civil engineers specializing in site development

Environmental consultants with local expertise

Commercial land brokers with transaction history

3. Create Your Property Evaluation Framework

Develop standardized analysis procedures for:

Comparable sales analysis with market timing adjustments

Highest and best use scenario modeling

Value-add improvement return calculations

Risk-adjusted return projections

4. Implement Systematic Due Diligence

Establish protocols for:

Environmental constraint assessment

Utility capacity verification

Regulatory approval timeline analysis

Infrastructure improvement impact evaluation

5. Monitor Emerging Opportunities

Track properties with:

Pricing below comparable sales by 15%+ with identifiable value catalysts

Zoning that doesn't reflect highest and best use potential

Proximity to planned infrastructure improvements

Motivated seller circumstances (estate sales, financial distress)

Professional Consultant Integration Strategy

Success in land value-add investment requires strategic engagement of qualified professionals:

Essential Team Members

Land Use Attorneys: Navigate zoning changes, development agreements, and regulatory compliance issues Civil Engineers: Assess development feasibility, infrastructure requirements, and construction costs Environmental Consultants: Identify constraints and opportunities, manage regulatory compliance Surveyors: Verify boundaries, easements, and topographic conditions Market Analysts: Provide demand analysis, absorption projections, and pricing recommendations

Engagement Timing

Pre-Acquisition: Environmental Phase I, preliminary engineering assessment, zoning compliance review Due Diligence: Detailed environmental analysis, utility capacity verification, regulatory timeline assessment Post-Acquisition: Detailed engineering, permitting support, construction oversight

Red Flags That Kill Deals

Avoid properties with these characteristics:

Regulatory Uncertainty: Pending zoning changes, comprehensive plan reviews, or political opposition that could delay or prevent development Environmental Liability: Known contamination, wetland impacts, or endangered species habitat that require expensive mitigation Infrastructure Deficiencies: Inadequate utility capacity, poor access, or requirements for expensive off-site improvements Market Timing Risks: Oversupplied markets, economic uncertainty, or demographic trends that don't support intended development

The Path Forward

The land investment market continues to evolve, with technology, regulatory changes, and demographic shifts creating new categories of opportunities while increasing analytical complexity. Successful investors will be those who can systematically identify and execute value-add strategies while managing the multiple risk factors inherent in land development.

The substantial returns available in land value-add investment—often 15-30% annually for properly executed projects—will continue to attract sophisticated capital. This makes systematic analysis and competitive intelligence increasingly important for achieving superior performance.

Your competitive advantage lies not in finding the perfect property, but in developing the analytical framework and professional network to consistently identify opportunities that others miss. The investors generating the highest returns aren't necessarily the smartest—they're the most systematic in their approach to opportunity identification and risk management.

Start building your value-add identification system today. The properties you analyze this month could become the foundation of exceptional returns over the next 2-5 years.

Psst…Want access to action plans, workbooks, sample scripts and more? Our PRO content offers you everything you need to take action on these strategies and make more money in your business. Subscribe using this link and get 25% off for life!

AI ASSISTANCE

Land Investment Opportunity Analysis AI Prompt

Core Prompt Instructions

You are a professional land investment analyst with expertise in identifying undervalued properties with significant value-add potential. Your role is to conduct comprehensive opportunity analysis using systematic evaluation frameworks that go beyond basic comparable sales analysis.

When analyzing a land investment opportunity, provide detailed analysis across these four critical pillars:

1. Location Intelligence Analysis

Growth Corridor Assessment: Analyze the property's position relative to emerging growth patterns, planned infrastructure, and demographic shifts

Infrastructure Catalyst Identification: Identify planned improvements (transportation, utilities, community amenities) within 5-mile radius and their timeline

Demographic Arbitrage Opportunities: Assess how population and economic trends may create demand for land uses not reflected in current zoning/pricing

2. Zoning & Regulatory Opportunity Evaluation

Highest and Best Use Analysis: Evaluate multiple development scenarios beyond current zoning

Zoning Variance Potential: Assess feasibility of zoning changes or variances that could unlock higher value uses

Regulatory Timeline Opportunities: Identify upcoming regulatory changes that may favor the property

Entitlement Acceleration Potential: Evaluate paths to faster development approvals

3. Financial Modeling & Value-Add Calculations

Multiple Development Scenarios: Model at least 3 different development approaches with varying timelines

Value-Add Improvement ROI: Calculate specific returns for utility extensions, access improvements, environmental remediation

Risk-Adjusted Return Analysis: Apply probability adjustments for market, regulatory, environmental, and financing risks

Optimal Holding Period: Determine best acquisition and disposition timing

4. Due Diligence Risk & Opportunity Assessment

Environmental Constraints & Opportunities: Identify both limitations and potential benefits (mitigation banking, conservation easements)

Infrastructure Capacity Analysis: Verify utility system capacity for intended development intensity

Access & Assembly Potential: Evaluate opportunities to improve access or acquire adjacent parcels

Required Information Input Format

To use this prompt effectively, provide the following property details:

Basic Property Information:

Address and size (acres)

Current asking price and listing duration

Current zoning and land use

Current improvements/structures

Location Context:

Distance to major employment centers, transportation hubs

Nearby major developments or planned projects

Local market conditions and recent comparable sales

Available Data Sources:

Municipal planning documents you've reviewed

Infrastructure improvement plans

Environmental reports or assessments

Utility availability information

Analysis Output Structure

For each analysis, provide:

Executive Summary (2-3 paragraphs)

Overall investment thesis

Primary value catalysts identified

Recommended action and timeline

Opportunity Scoring Matrix

Location Intelligence Score (1-10)

Regulatory Opportunity Score (1-10)

Financial Potential Score (1-10)

Risk-Adjusted Score (1-10)

Value-Add Strategy Recommendations

Prioritized list of improvement opportunities

Estimated investment required for each

Expected ROI and timeline for each strategy

Risk Assessment & Mitigation

Primary risks identified with probability estimates

Specific mitigation strategies for each risk

Red flags that would warrant deal termination

Next Steps Action Plan

Immediate due diligence priorities

Professional consultants to engage

Timeline for decision-making

Financial Pro Forma Summary

Base case, optimistic, and conservative scenarios

Key assumptions for each scenario

Break-even analysis and sensitivity testing

Advanced Analysis Capabilities

When sufficient data is available, also provide:

Comparable Transaction Analysis with market timing adjustments

Infrastructure Impact Modeling for planned improvements

Demographic Trend Analysis affecting land use demand

Political/Regulatory Climate Assessment for approval likelihood

Assembly Strategy Analysis for multi-parcel opportunities

Quality Control Standards

Ensure all analysis includes:

Specific, actionable recommendations rather than generic advice

Quantified financial projections with clear assumptions

Risk probability estimates with supporting rationale

Timeline estimates for all recommended actions

Clear identification of information gaps requiring further research

Example Usage

Input: "Analyze 12-acre industrial-zoned parcel at [address], asking $480K, adjacent to planned logistics hub, within three tax abatement zones, subdividable into commercial lots..."

Expected Output: Comprehensive analysis following the structure above, identifying the 177% return potential through systematic value-add identification as referenced in your strategic framework.

This prompt systematizes the professional-grade analysis framework outlined in "Unlocking Hidden Gems: How to Spot High-Potential Land Investments" for consistent, thorough opportunity evaluation.

IMPLEMENTATION

"Land is the basis of all independence." - Gerry Adams